box 12 on w2 emploee health distribution Jun 5, 2024 The chart below can be used to determine the equivalent sheet thickness, in inches or millimeters, for a gauge number from the selected gauge size standard. The weight per unit .

0 · w2 health insurance contributions

1 · w2 box 12 medicare

2 · w2 box 12 health insurance

3 · w2 box 12 contributions

4 · w2 box 12 code

5 · w2 box 12 401k

6 · w 2 box 12 hsa

7 · box 12 health insurance contributions

Effortlessly calculate the required electrical junction box size for your wiring project using our Electrical Junction Box Size Calculator. Input the number of conductors and select the box .

w2 health insurance contributions

custom cnc parts near me

w2 box 12 medicare

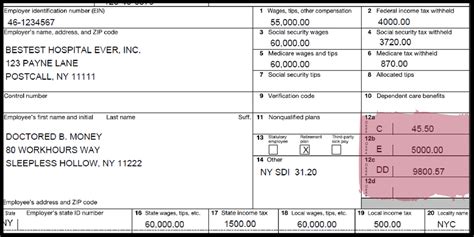

Individuals (employees) do not have to report the cost of coverage under an employer-sponsored group health plan that may be shown on their Form W-2, Wage and Tax Statement, in Box 12, . Jun 5, 2024 W2, box 12, code DD shows how much your employer-sponsored health insurance plan costs. It's not taxable income. Here is what is included.

If you offer your health stipend on a reimbursement basis, you can withhold taxes on your employees’ W-2 as imputed income. You can report imputed income on Form W-2 in Box 12 using Code C and Boxes 1, 3, and 5. .The UPPER-CASE (capital) letters in box 12 report different things to the IRS. Here's a list of what each one means. Box 12 codes. A: Uncollected social security or RRTA tax on tips reported to .According to the W-2 instructions from the IRS, the following list explains the codes shown in box 12 on the W-2: Elective deferrals to a section 401 (k) cash or deferred arrangement. Also .

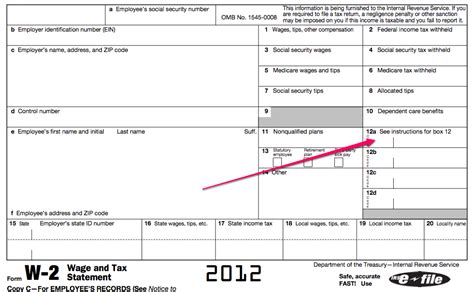

Box 12 on your W-2 form reports several different types of compensation and benefits. If applicable, this box will indicate a single or double letter code followed by a dollar amount. Here’s what those codes mean:Read more as we outline the instructions for box 12 on a W-2 form to help you as you compute income tax on your wages, whether they’re from your paycheck, state wages, Medicare wages, Social Security wages, or otherwise.

custom cnc lathe parts pricelist

Box 12 — Various Form W-2 codes on box 12 reflect different types of compensation or benefits. This is one of the more complex W-2 boxes, with codes ranging from A to HH. Gain more insight into W-2 box 12 codes. Reporting on the Form W-2. Employers that are subject to this requirement should report the value of the health care coverage in Box 12 of the Form W-2 PDF, with Code DD to identify the amount. There is no reporting on the Form W-3 of the total of these amounts for all the employer’s employees.Individuals (employees) do not have to report the cost of coverage under an employer-sponsored group health plan that may be shown on their Form W-2, Wage and Tax Statement, in Box 12, using Code DD. Each year, you need to file Form W-2 for your employees. You might need to use Form W-2 Box 12 codes to accurately fill out Form W-2. If you are not familiar with Box 12, there are currently 26 codes to report certain compensation and benefit amounts.

W2, box 12, code DD shows how much your employer-sponsored health insurance plan costs. It's not taxable income. Here is what is included. If you offer your health stipend on a reimbursement basis, you can withhold taxes on your employees’ W-2 as imputed income. You can report imputed income on Form W-2 in Box 12 using Code C and Boxes 1, 3, and 5. Employers must also withhold Social Security and Medicare taxes for stipends.The UPPER-CASE (capital) letters in box 12 report different things to the IRS. Here's a list of what each one means. Box 12 codes. A: Uncollected social security or RRTA tax on tips reported to your employer; AA: Designated Roth contributions under a section 401(k) plan

According to the W-2 instructions from the IRS, the following list explains the codes shown in box 12 on the W-2: Elective deferrals to a section 401 (k) cash or deferred arrangement. Also includes deferrals under a SIMPLE retirement account that is part of a section 401 (k) arrangement. Employer contributions to your Archer MSA.

Box 12 on your W-2 form reports several different types of compensation and benefits. If applicable, this box will indicate a single or double letter code followed by a dollar amount. Here’s what those codes mean:

Read more as we outline the instructions for box 12 on a W-2 form to help you as you compute income tax on your wages, whether they’re from your paycheck, state wages, Medicare wages, Social Security wages, or otherwise.

Box 12 — Various Form W-2 codes on box 12 reflect different types of compensation or benefits. This is one of the more complex W-2 boxes, with codes ranging from A to HH. Gain more insight into W-2 box 12 codes.

Reporting on the Form W-2. Employers that are subject to this requirement should report the value of the health care coverage in Box 12 of the Form W-2 PDF, with Code DD to identify the amount. There is no reporting on the Form W-3 of the total of these amounts for all the employer’s employees.Individuals (employees) do not have to report the cost of coverage under an employer-sponsored group health plan that may be shown on their Form W-2, Wage and Tax Statement, in Box 12, using Code DD. Each year, you need to file Form W-2 for your employees. You might need to use Form W-2 Box 12 codes to accurately fill out Form W-2. If you are not familiar with Box 12, there are currently 26 codes to report certain compensation and benefit amounts. W2, box 12, code DD shows how much your employer-sponsored health insurance plan costs. It's not taxable income. Here is what is included.

If you offer your health stipend on a reimbursement basis, you can withhold taxes on your employees’ W-2 as imputed income. You can report imputed income on Form W-2 in Box 12 using Code C and Boxes 1, 3, and 5. Employers must also withhold Social Security and Medicare taxes for stipends.

The UPPER-CASE (capital) letters in box 12 report different things to the IRS. Here's a list of what each one means. Box 12 codes. A: Uncollected social security or RRTA tax on tips reported to your employer; AA: Designated Roth contributions under a section 401(k) planAccording to the W-2 instructions from the IRS, the following list explains the codes shown in box 12 on the W-2: Elective deferrals to a section 401 (k) cash or deferred arrangement. Also includes deferrals under a SIMPLE retirement account that is part of a section 401 (k) arrangement. Employer contributions to your Archer MSA. Box 12 on your W-2 form reports several different types of compensation and benefits. If applicable, this box will indicate a single or double letter code followed by a dollar amount. Here’s what those codes mean:

Read more as we outline the instructions for box 12 on a W-2 form to help you as you compute income tax on your wages, whether they’re from your paycheck, state wages, Medicare wages, Social Security wages, or otherwise.

Steel wool can be made from either stainless steel or carbon steel. Stainless steel is softer and safer for many aged wood project projects, but carbon steel has a better resolution and resists corrosion better. Steel wool is great for your wood furniture and cabinets. It will remove those tough stains easily.

box 12 on w2 emploee health distribution|w2 box 12 code