1099 form for 401k distribution box 5 File Form 1099-R for each person to whom you have made a designated distribution . In this cnc product list article, we will be going through 32 product ideas that you can make with your CNC machine, as well as sites where you sell these products. Before we jump into the list, here are some handy primers for CNC machines and typical CNC materials: CNC stands for computer numerical control.

0 · irs form 1099 r instructions

1 · form 1099 r pdf

2 · form 1099 r distribution code

3 · 1099 r pension distribution

4 · 1099 r ira distribution code

5 · 1099 r 5498 distribution code

6 · 1099 r 401k distribution

7 · 1099 r 401k

Deciding what to do with these boxes may seem challenging, but it’s actually an opportunity to get creative and environmentally conscious. Instead of immediately tossing them into the recycling bin, consider the numerous .

irs form 1099 r instructions

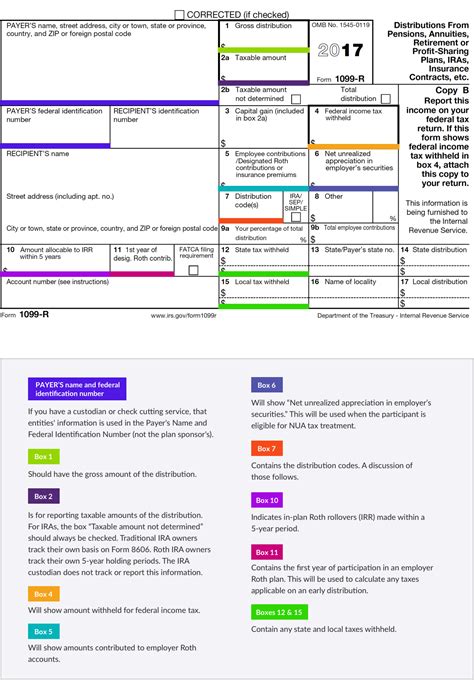

For a direct rollover of a distribution from a section 401(k) plan, a section 403(b) plan, or a governmental section 457(b) plan to a designated Roth account in the same plan, enter the amount rolled over in box 1, the taxable amount in box 2a, and any basis recovery amount in .File Form 1099-R for each person to whom you have made a designated distribution .File Form 1099-R for each person to whom you have made a designated distribution or are treated as having made a distribution of or more from: Profit-sharing or retirement plans. .For distributions made after December 31, 2023, a distribution to a domestic abuse victim may be made from a 403(b) plan and is not subject to the 10% additional tax on early distributions.

You'll want to check box your Forms 5498 from the Roth and traditional IRAs to see how much was actually deposited into each by the rollover to see if the amounts correspond to . Box 5 - Employee contributions / Designated Roth contributions or insurance premiums generally shows the taxpayer's investment in the contract (after-tax contributions), if any, recovered tax free this year. You must file Form 1099-R with the IRS if you have given away or are treated as having made a distribution of or more from any of the following: Pensions. Annuities.

The 1099-R from OPM, box 5 is after-tax dollars (excluded from box 1). If you can determine the portion that belongs to medical expenses, they are deductible. The same is true .When you take a distribution from your 401 (k), your retirement plan will send you a Form 1099-R. This tax form shows how much you withdrew overall and the federal and state taxes withheld from the distribution if applicable. This tax .Regarding 1099-R distribution codes, retirement account distributions on Form 1099-R, Code 4 are taxable based on the amounts in Box 2a. Include the federal withholding amount reported in Box 4 as an additional withholding. IRS Form 1099-R reports income received from IRAs, pensions, retirement plans, profit-sharing plans, insurance contracts, and annuities. Whether you're required to pay taxes .

For a direct rollover of a distribution from a section 401(k) plan, a section 403(b) plan, or a governmental section 457(b) plan to a designated Roth account in the same plan, enter the amount rolled over in box 1, the taxable amount in box 2a, .File Form 1099-R for each person to whom you have made a designated distribution or are treated as having made a distribution of or more from: Profit-sharing or retirement plans. Any individual retirement arrangements (IRAs).For distributions made after December 31, 2023, a distribution to a domestic abuse victim may be made from a 403(b) plan and is not subject to the 10% additional tax on early distributions.

You'll want to check box your Forms 5498 from the Roth and traditional IRAs to see how much was actually deposited into each by the rollover to see if the amounts correspond to these suspicions. If they do not, something might be . Box 5 - Employee contributions / Designated Roth contributions or insurance premiums generally shows the taxpayer's investment in the contract (after-tax contributions), if any, recovered tax free this year.

You must file Form 1099-R with the IRS if you have given away or are treated as having made a distribution of or more from any of the following: Pensions. Annuities.

The 1099-R from OPM, box 5 is after-tax dollars (excluded from box 1). If you can determine the portion that belongs to medical expenses, they are deductible. The same is true with FEHB, any post tax dollars count for medical expenses.

When you take a distribution from your 401 (k), your retirement plan will send you a Form 1099-R. This tax form shows how much you withdrew overall and the federal and state taxes withheld from the distribution if applicable. This tax form for 401 (k) distribution is sent when you’ve made a distribution of or more.

Regarding 1099-R distribution codes, retirement account distributions on Form 1099-R, Code 4 are taxable based on the amounts in Box 2a. Include the federal withholding amount reported in Box 4 as an additional withholding. IRS Form 1099-R reports income received from IRAs, pensions, retirement plans, profit-sharing plans, insurance contracts, and annuities. Whether you're required to pay taxes on this income depends on the source. Distributions from a traditional 401 (k), for example, are usually taxable. Distributions from a Roth IRA may be tax-free.For a direct rollover of a distribution from a section 401(k) plan, a section 403(b) plan, or a governmental section 457(b) plan to a designated Roth account in the same plan, enter the amount rolled over in box 1, the taxable amount in box 2a, .File Form 1099-R for each person to whom you have made a designated distribution or are treated as having made a distribution of or more from: Profit-sharing or retirement plans. Any individual retirement arrangements (IRAs).

For distributions made after December 31, 2023, a distribution to a domestic abuse victim may be made from a 403(b) plan and is not subject to the 10% additional tax on early distributions.

form 1099 r pdf

You'll want to check box your Forms 5498 from the Roth and traditional IRAs to see how much was actually deposited into each by the rollover to see if the amounts correspond to these suspicions. If they do not, something might be . Box 5 - Employee contributions / Designated Roth contributions or insurance premiums generally shows the taxpayer's investment in the contract (after-tax contributions), if any, recovered tax free this year.

You must file Form 1099-R with the IRS if you have given away or are treated as having made a distribution of or more from any of the following: Pensions. Annuities. The 1099-R from OPM, box 5 is after-tax dollars (excluded from box 1). If you can determine the portion that belongs to medical expenses, they are deductible. The same is true with FEHB, any post tax dollars count for medical expenses.When you take a distribution from your 401 (k), your retirement plan will send you a Form 1099-R. This tax form shows how much you withdrew overall and the federal and state taxes withheld from the distribution if applicable. This tax form for 401 (k) distribution is sent when you’ve made a distribution of or more.Regarding 1099-R distribution codes, retirement account distributions on Form 1099-R, Code 4 are taxable based on the amounts in Box 2a. Include the federal withholding amount reported in Box 4 as an additional withholding.

graybar electric floor boxes

Whether you’re a MIG welder, a TIG welder, or want a machine you can do both with, we have reviewed a range of different welders to help you narrow down a good choice for your next project. 1. Miller Electric 211 – Best MIG Welder.

1099 form for 401k distribution box 5|1099 r 401k distribution