1099 r box 14 state distribution Find TurboTax help articles, Community discussions with other TurboTax users, . Product Name: Waterproof Junction Box, Electrical Boxes, Project box ; Waterproof Rating: IP65. High Quality Material: Made of ABS material, Sturdy and terrific for making those DIY projects. Easy to drill and shape openings for many items like meters, LCDs, sockets, LEDs, buttons and so on. Enjoy flexible payments on millions of products.

0 · is a 1099 r taxable

1 · irs 1099 r distribution codes

2 · irs 1099 r 2023

3 · internal revenue service 1099 r

4 · gross distribution on 1099 r

5 · 1099 r form pdf

6 · 1099 r boxes explained

7 · 1099 r box 16 blank

Shop this Zvex Box of Metal high-gain effect pedal today. Overview:The Box of Metal (tm) is an aggressive high-gain pedal with a highly-effective built-in switchable gate which dramatically reduces noise and unwanted feedback.

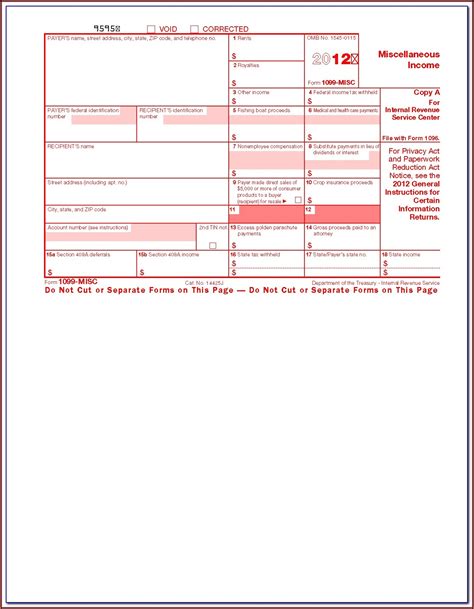

There is NO box 12a on the 1099-R but Box 14 labelled state tax withheld, which TT has highlighted, is greater than empty Box 15 titled State distribution. Additionally, the amount highlighted in Box 14 IS less than box 1 Gross distribution.There is NO box 12a on the 1099-R but Box 14 labelled state tax withheld, which TT .TurboTax is here to make the tax filing process as easy as possible. We're .

Find TurboTax help articles, Community discussions with other TurboTax users, .

We would like to show you a description here but the site won’t allow us.If an IRA conversion contribution or a rollover from a qualified plan is made to a Roth IRA that is later revoked or closed, and a distribution is made to the taxpayer, enter the gross distribution . State distribution box is blank on 1099-R, line 14. state withholding shows an amount in Box 12. should I enter the gross distribution from box 1? Box 2a is empty? For .

In both the online and download versions TurboTax shows Box 12 as "FATCA filing requirement box is checked" and Box 14 as "State Tax Withheld." If you are using the . In this article, we’ll walk through IRS Form 1099-R, including: A comprehensive look at what you should see in each box of this tax form; .For distributions from a Roth IRA, generally the payer isn’t required to compute the taxable amount. You must compute any taxable amount on Form 8606. An amount shown in box 2a . Earnings on Roth contributions are subject to the 10% additional tax when withdrawn within five years of the first contribution. Boxes 14 – 19 show state and local tax withholdings as well as the part of the distribution reported .

Regarding 1099-R distribution codes, retirement account distributions on Form 1099-R, Code 4 are taxable based on the amounts in Box 2a. Include the federal withholding amount reported in Box 4 as an additional withholding.

is a 1099 r taxable

Distributions from other sources can also be reported on a 1099-R, and it’s possible to get one even if you’re not a retiree making withdrawals to fund your retirement. Knowing what to do with a 1099-R can help you accurately . Answered: 1099-R Taxable distribution in box 2a. Also NY state tax withheld $'s in box 14, but state tax distribution in box 16 blank. Proseries will

20x20 junction box

My state tax filing is being held up by Turbo-tax who is asking me to check my FORM 1099-R because State tax was withheld but no state distribution amount was entered by the issuer of the 1099-R. Message from Turbo tax states: Check this Enty: Form 1099-R: Box 12a For electronic Filing, New York State withholdings cannot be greater than or equal to gross distribution or . On my 1099-R Box 12 is "FATCA filing requirement" and box 14 states "State tax withheld", turbo tax calls box 12 "amount withheld" and box 14 "State distribution amt" Apparently there's something wrong herewith turbo tax. If your 1099-R has a state withholding in Box 14, you must enter Line 15 and 16 as well. If your 1099-R does not have a state payer number, it is possible that they do not have one. Not every payer of retirement distributions has obtained payer numbers for every state. You should try and contact the payer for their NY state identification number.

2) A CSF- or CSA-1099-R from OPM has State "withholding" in box 12 and total state distribution in box 14. ____________*Answers are correct to the best of my knowledge when posted, but should not be considered to be legal or official tax advice.* @Tpaoli70 1099-R box 14 is state tax withheld. Box 15 is the state and ID. Box 16 is the distribution amount. If you are a full year resident, you can use your box 2a amount in box 16. NOTE: prior to 2020 the state tax was in boxes 12-14, 2020 renumbered those boxes to 14-16. Box 16 is not usually required because it has been an 1099-R industrial standard for many years that if there is only one state in box 14 & 15 then the box 1 amount does not need to be allocated between two states - the entire box 1 amount is understood to be the state .

irs 1099 r distribution codes

Thanks to all for weighing in on the 1099-R Box 14 New York State fiasco. I got hung up on this last year and had to file an amended paper return to NYS. I brought this issue up to both NYS and TurboTax. I just received my 2019 Fidelity 1099-R. Box 1-2 = 00, Box 12 = 80, Box 14 blank. According to NYS, Box 12 cannot be greater or equal to . If there is an entry in Boxes 14 or 15 on your 1099-R, TurboTax will expect an amount in Box 16. If Box 14 shows State Tax withheld, you can enter the amount from Box 2a. If no state tax was withheld, you can delete the State ID number, so that Boxes 14, 15, and 16 are blank. See this article for more information on Form 1099-R.

Box 16 is the state amount of the distribution. In most cases it is the same as Box 1 - gross distribution. If there is an entry in Boxes 14 or 15 on your 1099-R, TurboTax will expect an amount in Box 16. Enter the following in Box 16: If Box 14 shows State Tax withheld, enter the amount in Box 1 (gross distribution);1099-R Box 14a for efiling New York State withholdings can not be greater than or equal to gross distribution or state distribution (nothing in box 16 on my form). Yes. Box 14 (State Tax Withheld) is the same as Box 1 (Gross Distribution).

My state tax filing is being held up by Turbo-tax who is asking me to check my FORM 1099-R because State tax was withheld but no state distribution amount was entered by the issuer of the 1099-R. Message from Turbo tax states: Check this Enty: Form 1099-R: Box 12a For electronic Filing, New York State withholdings cannot be greater than or equal to gross distribution or .

On my 1099-R Box 12 is "FATCA filing requirement" and box 14 states "State tax withheld", turbo tax calls box 12 "amount withheld" and box 14 "State distribution amt" Apparently there's something wrong herewith turbo tax. If your 1099-R has a state withholding in Box 14, you must enter Line 15 and 16 as well. If your 1099-R does not have a state payer number, it is possible that they do not have one. Not every payer of retirement distributions has obtained payer numbers for every state. You should try and contact the payer for their NY state identification number.

2) A CSF- or CSA-1099-R from OPM has State "withholding" in box 12 and total state distribution in box 14. ____________*Answers are correct to the best of my knowledge when posted, but should not be considered to be legal or official tax advice.* @Tpaoli70 1099-R box 14 is state tax withheld. Box 15 is the state and ID. Box 16 is the distribution amount. If you are a full year resident, you can use your box 2a amount in box 16.

NOTE: prior to 2020 the state tax was in boxes 12-14, 2020 renumbered those boxes to 14-16. Box 16 is not usually required because it has been an 1099-R industrial standard for many years that if there is only one state in box 14 & 15 then the box 1 amount does not need to be allocated between two states - the entire box 1 amount is understood to be the state .

irs 1099 r 2023

Thanks to all for weighing in on the 1099-R Box 14 New York State fiasco. I got hung up on this last year and had to file an amended paper return to NYS. I brought this issue up to both NYS and TurboTax. I just received my 2019 Fidelity 1099-R. Box 1-2 = 00, Box 12 = 80, Box 14 blank. According to NYS, Box 12 cannot be greater or equal to . If there is an entry in Boxes 14 or 15 on your 1099-R, TurboTax will expect an amount in Box 16. If Box 14 shows State Tax withheld, you can enter the amount from Box 2a. If no state tax was withheld, you can delete the State ID number, so that Boxes 14, 15, and 16 are blank. See this article for more information on Form 1099-R.

Box 16 is the state amount of the distribution. In most cases it is the same as Box 1 - gross distribution. If there is an entry in Boxes 14 or 15 on your 1099-R, TurboTax will expect an amount in Box 16. Enter the following in Box 16: If Box 14 shows State Tax withheld, enter the amount in Box 1 (gross distribution);

2023 pro set metal football hobby box

22 ga galvanized sheet metal

Zinger Sheet Metal specializes in fabricating rectangular, round and oval HVAC duct and fittings. We will provide creative and innovative solutions to HVAC contractors. Our professional sales team is ready to assist you with your next project regardless of size.

1099 r box 14 state distribution|gross distribution on 1099 r