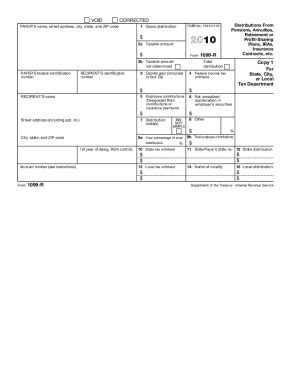

what is box 16 state distribution You need to enter the box 1 amount in box 16 for State Distribution. This will tell Turbo Tax the amount of the gross NY distribution and clear the error. The pandemic has affected your taxes in many ways. Including reporting in TurboTax the amount of stimulus money you received. Tweed Sheetmetal Pty Ltd Catering Supplies - Tweed Heads, Queensland, 2485, Business Owners - Is Tweed Sheetmetal Pty Ltd in Tweed Heads, QLD your business? Attract more customers by adding more content such as opening hours, logo and more - .

0 · taxable amount not determined

1 · irs form for pension income

2 · form 1099 r box 2a

3 · 1099 r taxable amount

4 · 1099 r is for what

5 · 1099 r boxes explained

6 · 1099 r box 8

7 · 1099 r box 16 blank

Turn to Turner for your roof repair and installation. Turner Roofing is a top residential and commercial roofing company in Tulsa.

fan rated metal box

taxable amount not determined

You need to enter the box 1 amount in box 16 for State Distribution. This will tell Turbo Tax the amount of the gross NY distribution and clear the error. The pandemic has affected your taxes in many ways. Including reporting in TurboTax the amount of stimulus money you received.You need to enter the box 1 amount in box 16 for State Distribution. This will tell .TurboTax is here to make the tax filing process as easy as possible. We're .

irs form for pension income

Install or update products Tax filing status State topics Choose products. Income. .

We would like to show you a description here but the site won’t allow us.Box 16 is the state amount of the distribution. In most cases it is the same .

If there is an entry in Boxes 14 or 15 on your 1099-R, TurboTax will expect an amount in Box 16. If Box 14 shows State Tax withheld, you can enter the amount from Box 2a. If no state tax was withheld, you can delete the State .In box 15, enter the abbreviated name of the state and the payer's state identification number. The state number is the payer's identification number assigned by the individual state. In box 18, .

His 1099-R shows a taxable distribution in box 1 and 2 for fed taxes. However, box 16 (state distribution) does not show an amount. Does that mean this pension/retirement . The abbreviated name of the state and the payer’s state identification number should appear in Box 15. Box 16: State distribution If applicable, this box contains the distribution amount subject to state taxes.Box 7. Distribution Codes. Identifies the type of distribution received. For more information, see the federal income tax return instructions. Distribution codes 2= Early distribution, exception . The payer populates their state identification number here (you should have a value here if you have an amount in Box 14 on your 1099-R). Box 16. This box shows the .

Form 1099-R will usually show items such as the gross amount of the distribution, the taxable amount (what is actually going to be taxed), tax withholding (federal and state), and a . Box 16 is the state amount of the distribution. In most cases it is the same as Box 1 - gross distribution. If there is an entry in Boxes 14 or 15 on your 1099-R, TurboTax will expect . The box is labeled "State distribution". US En . United States (English) United States (Spanish) Canada (English) Canada (French) TURBOTAX; . (NC) I must use the box 2a value as the NC state distribution to be entered into box 16. _____*Answers are correct to the best of my knowledge when posted, but should not be considered to be legal or . The state distribution on the 1099-R is posted to box 16. If the state indicated is Ohio, it means that that portion of the distribution is taxable in Ohio. This is very often the state you live in. If you disagree with that, the first place to start is with the plan administrator.

If the state allows up-to a 10,000 state income deduction for any pension, and box 1 is 13,000, and 2a is 8,000, then the state distribution amount needs to be 2a, because only 8k can be deducted, since only 8,000 was included in the Federal AGI in the first place. Ohio? I really don't know the details of how that box 16 state distribution is used Box 16 on Form 1099-R is where the state income distribution is reported. It is possible if you leave that entry blank when you prepare your state tax return the distribution won't appear as taxable on it. You can look at your state tax summary to determine if the proper income is being reflected on it by following these steps in TurboTax: The retirement distribution is reported on Form 1099-R. The amount on Box1 1099-R is the gross distribution from your retirement plan. If line 16 of 1099-R was left blank, you needed to enter the amount from Box 2 which was the taxable amount of the distribution. On my 2022 form 1099-r there is no amount in box 16 for state distribution but state tax was withheld. What amount should I put in box 10 for state distribution? Enter the amount in box 1 of the Form 1099-R in the box 16. April 15, 2023 7:47 AM. 0 1,463 Bookmark Icon. RellBug92. New Member Mark as New; Bookmark;

I have been doing backdoor roth conversion for several years. in my 1099-R forms 2021 and 2022 box 7 always showed code 2 (for roth conversion). However there is a difference between 2022 form and the previous years. Box 16 (state distribution) in 2021 and 2020 showed blank. Box 16 in 2022 form showed the full contribution amount (k for age 50+).

NOTE: prior to 2020 the state tax was in boxes 12-14, 2020 renumbered those boxes to 14-16. Box 16 is not usually required because it has been an 1099-R industrial standard for many years that if there is only one state in box 14 & 15 then the box 1 amount does not need to be allocated between two states - the entire box 1 amount is understood to be the state . 1099-R Box 14a for efiling New York State withholdings can not be greater than or equal to gross distribution or state distribution (nothing in box 16 on my form). @Diane471 The people who issued that 1099-R have used an improper formatting for .

You should try and contact the payer for their NY state identification number. If you are unable retrieve a state identification number, you could enter their federal EIN (as shown under the Payer's TIN box) for your Box 15 input. Lastly, enter your state for Box 16. Once complete, you should be able to e-file. State withholding goes in box 14. State ID and ID number in box 15. State distribution in box 16 ...(IF no state distribution shows on your 1099-R form, some states require you to put the value of box 2a into box 16 in the software ...or the federally taxable amount of box 1 if box 2a is empty) Normally, the value of box 2a would be entered into box 16 if box 2a contains a real $$ value. If box 2a is empty, or undetermined, then the Federally-taxable amount of box 1 is entered as box 16 (unless the person made after-tax contributions to that type of retirement fund, that $$ amount is just box 1) For Box 16 (State distribution), enter the distribution as shown in Box 1 (Gross distribution). If it is non-taxable in NYS based on the guidelines above, please follow the on-screen instructions and answer the questions pertaining to your 1099-R.

Solved: I have a 1099-R, but there is no box 16 that Turbo taxes says there should be for the State Distribution. Should I enter the amount from the Gross. US En . United States (English) United States (Spanish) Canada (English) Canada (French) TURBOTAX; Expert does your taxes. Back. Box 15. The payer populates their state identification number here (you should have a value here if you have an amount in Box 14 on your 1099-R). Box 16. This box shows the amount of your state distribution (you should have a value in Box 15 of your 1099-R if you have a value here). Box 17. This box shows the amount of local income tax withheld .

form 1099 r box 2a

Box 14 has state tax withheld but there is nothing on box 16, state distribution. Lev. Taxes, Immigration, Labor Relations. 77,525 Satisfied Customers. i am trying to show how i rolled over my previous employer. Robin D. 15 years with a leading Tax Service. Divisional leader, Instructor. 63,151 Satisfied Customers.

1099 r taxable amount

Box 14a on Form 1099-R is the amount of state tax withheld from your distribution. If that amount is the same as Box 1, that means your entire retirement distribution was withheld for state taxes. That doesn't sound right. Box 1 and box 16 are usually the same, but I would expect the amount in 14a to be much lower. Can you clarify your question?1099-R Box 14a for (e)filing New York State withholdings can not be greater than or equal to gross distribution or state distribution (nothing in box 16 on my form). On my my form: 1099-R there are fields that are not compatibles with Turbo Tax entry form: example, Box 14a.1099-R Question: State Tax Withheld (box15) must be less than State Distribution (Box 16) Problem is my box16 is empty. Official Response How do i find out what my state distribution is? Box1: 143,900 Box2: 143900 Box4: 14390 Box7: 4 Box14: 4097 (Michigan), 475(California) Edit: Title should say box14, then box16. My bad Share .

If box 2a is empty , then box 16 must be the Federally-taxable amount of box 1..which is usually box 1, but not always. Yeah, most 1099-R forms are issued with box 16 empty, but the software needs that value in there for a variety of reasons.

facebook marketplace metal tool boxes

Box 12 as Amount Withheld. The amount is correct for Amount Withheld, but the box number is wrong. Box 13 is the State and Number. Box 14 is State Distribution Amount. Matches State Distribution Amount in the first page, but wrong box number. Boxes 15 and 16 are not shown on this page. It looks like only the box numbers are wrong on this second . Box 14a For electronic filing, New York State withholdings can not be greater than or equal to gross distribution or state distribution. I have spent too much time on this. I have gone over everything and the NYS tax directions. Something is wrong. It is not a complicated calculation to figure out the NYS tax. What is the answer? Box 16: State wages, tips, etc. – This box reports the total amount of taxable income the employee earned in that state. This box can be used to report wages from two states, separated by the broken line. Box 17: State income tax – This box reports the total amount of state income tax that was withheld from the employee’s wages (from Box .

I called NY State Tax department, and their answer is that since the 1099-R is a federal form, they can't answer as to what, if anything, needs to be in box 16. (Even though the IRS instructions for filling out a 1099-R reads that boxes14-19 are reserved for local use!Maybe box 16 of a 1099-R form? If so, then it's usually the same as box 2a of the 1099-R form..IF b0ox 2a has a real value in it. IF box 2a is empty (or 2b is checked as "undetermined"), then it's the Federally-taxable amount from box 1 (which is usually just the box 1 value).Box 14 has state tax withheld but there is nothing on box 16, state distribution. Lev. Taxes, Immigration, Labor Relations. 77,536 Satisfied Customers. TurboTax online is malfunctioning. In reference to my 1099-R's, it keeps telling me that the New York State Withholding. Barbara.You should try and contact the payer for their NY state identification number. If you are unable retrieve a state identification number, you could enter their federal EIN (as shown under the Payer's TIN box) for your Box 15 input. Lastly, enter your state for Box 16. Once complete, you should be able to e-file.

factive cnc parts

Established in 2001, Tweed Sheetmetal has over 30 years experience in the industry and strives to offer the best quality products, competitive pricing and friendly service to all of his.

what is box 16 state distribution|1099 r box 8